mchenry county illinois property tax due dates 2021

In our drive up facility. We are located at 111 West Fox Street Yorkville on the 1 st floor Room 114.

/cloudfront-us-east-1.images.arcpublishing.com/gray/XIO4QZEEVJBSNLPWGDLAYSFJJY.png)

If You Claimed Unemployment In 2021 You Need This Tax Form To File In 2022

Duplicate bills are available on-line.

. Woodstock is the county seat of McHenry County where. 2200 N Seminary AveThe McHenry County Assessors Office is located in Woodstock Illinois. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N.

McHenry County Property Tax Inquiry. Visa Debit card 395 flat fee. Tuesday March 2 2021.

On June 14 2021 the Intervenor requested an additional 65-day extension to submit evidence. Tax Year 2020 First Installment Due Date. You may pay your real estate taxes in person at the Kendall County Collectors Office.

Payments can be made with cash check or credit cards. Said court in the above entitled cause Bill Prim Sheriff of McHenry County Illinois will on Thursday the_____day of_____AD. 2021 Taxes Payable in.

Friday October 1 2021. No personal checks or postmarks accepted. And was granted a 90-day extension to submit evidence with a due date of January 20 2021.

When searching choose only one of the listed criteria. On July 8 2021 the Intervenor was granted a Final 60-day extension with a due date of September 6 2021. Options for paying your property tax bill.

Under Illinois law areas under a disaster declaration can waive fees and change due dates on property taxes. We also have a drop box located outside where you can drop of your payments anytime. Property Tax Relief 2021 Distributed as a public service for property owners by.

Electronic check payments E-Checks have a flat fee depending on the payment amount. Due dates are June 7 and September 7 2021. All other debit cards have a 235 convenience fee.

The median property tax also known as real estate tax in McHenry County is 522600 per year based on a median home value of 24970000 and a median effective property tax rate of 209 of property value. McHenry County has one of the highest median property taxes in the United. Chicagoland Il - Area Counties 2020- 2nd Installment Property Tax Due Dates Chicagoland Mchenry Dekalb County.

To search for tax information you may search by the 10 digit parcel number last name of property owner or site address. McHenry County collects on average 209 of a propertys assessed fair market value as property tax. First Installment of 2021 Cook County Property Taxes.

Illinois taxes due date 2021. The McHenry County Assessor is responsible for appraising real estate and assessing a property tax on properties located in McHenry County Illinois. 209 of home value.

Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of. Yearly median tax in McHenry County. Tuesday March 1 2022.

Tax bills are scheduled to be mailed out May 7 with installment due dates set for June 7 and Sept. Delinquent tax sale december 7 2021. McHenry County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Welcome to ford county illinois. Bank issued checks mortgage company checks title company checks attorney checks certifiedcashiers checks money orders. 20___ at the hour of 1000 AM McHenry County Courthouse Room 262 2200 N.

Property tax bills mailed. Contact your county treasurer for payment due dates. Montgomery County Illinois Clerk Recorder.

The median property tax in McHenry County Illinois is 5226 per year for a home worth the median value of 249700. Credit card payments have a 235 convenience fee. Do not enter information in all the fields.

Tax Year 2020 Second Installment Due Date. Richmond Road Johnsburg IL 60051 8153850175 8153225150 Fax Website. The lobby of the Treasurer office has reopened.

Tax Year 2021 First Installment Due Date. All 102 counties in Illinois. The due dates for both installments is october 15 2021.

Late Payment Interest Waived through Monday May 3 2021. Learn all about McHenry real estate tax. October 12 2021 2020 Delinquent Real Estate Tax Sale Registration Deadline.

2021 Real Estate Tax Calendar payable in 2022 May 2nd. Whether you are already a resident or just considering moving to McHenry to live or invest in real estate estimate local property tax rates and learn how real estate tax works. On November 18 2020 Christopher Sherer entered his appearance on behalf of the board of review requested the PTAB grant an additional 90-day extension of time to have an appraisal performed.

DuPage County Collector PO. Between October 19thand November 18th we will accept only the following in addition to exact cash. Box 4203 Carol Stream IL 60197-4203.

The drive-up service is also available. You can contact the McHenry County Assessor for. The Online Property Inquiry tool updates every hour to reflect the most recent payments.

We are open during the hours of 800 am to 430pm Monday thru Friday except for holidays. Granted the CBOE a 90-day extension to submit evidence with a due date of June 30 2021. When Do You Have their Pay Contact your county treasurer for Illinois payment due dates In most counties real property taxes are paid about two installments usually.

Beginning May 2 2022 through September 30 2022 payments may also be mailed to. County Farm Road Wheaton IL 60187. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax.

The exact property tax levied depends on the county in Illinois the property is located in. McHenry Township Assessor Mary Mahady CIAO 3703 N. The subject property has a total.

On August 30 2021 the. Seminary Avenue Woodstock McHenry County Illinois sell at public auction to the highest and best bidder for cash. Last day to submit changes for ACH withdrawals for.

In most counties property taxes are paid in two installments usually June 1 and September 1. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

Taxes Fees Long Grove Illinois

8147 Aarwood Trl Nw Rapid City Mi 49676 Waterfront Homes Rapid City City

How To Become A Real Estate Agent In Illinois In 4 Easy Steps

Illinois Continues Double Digit Home Sales And Price Increases In February Illinois Realtors

Tax Lien Registry Tax Lien Registry

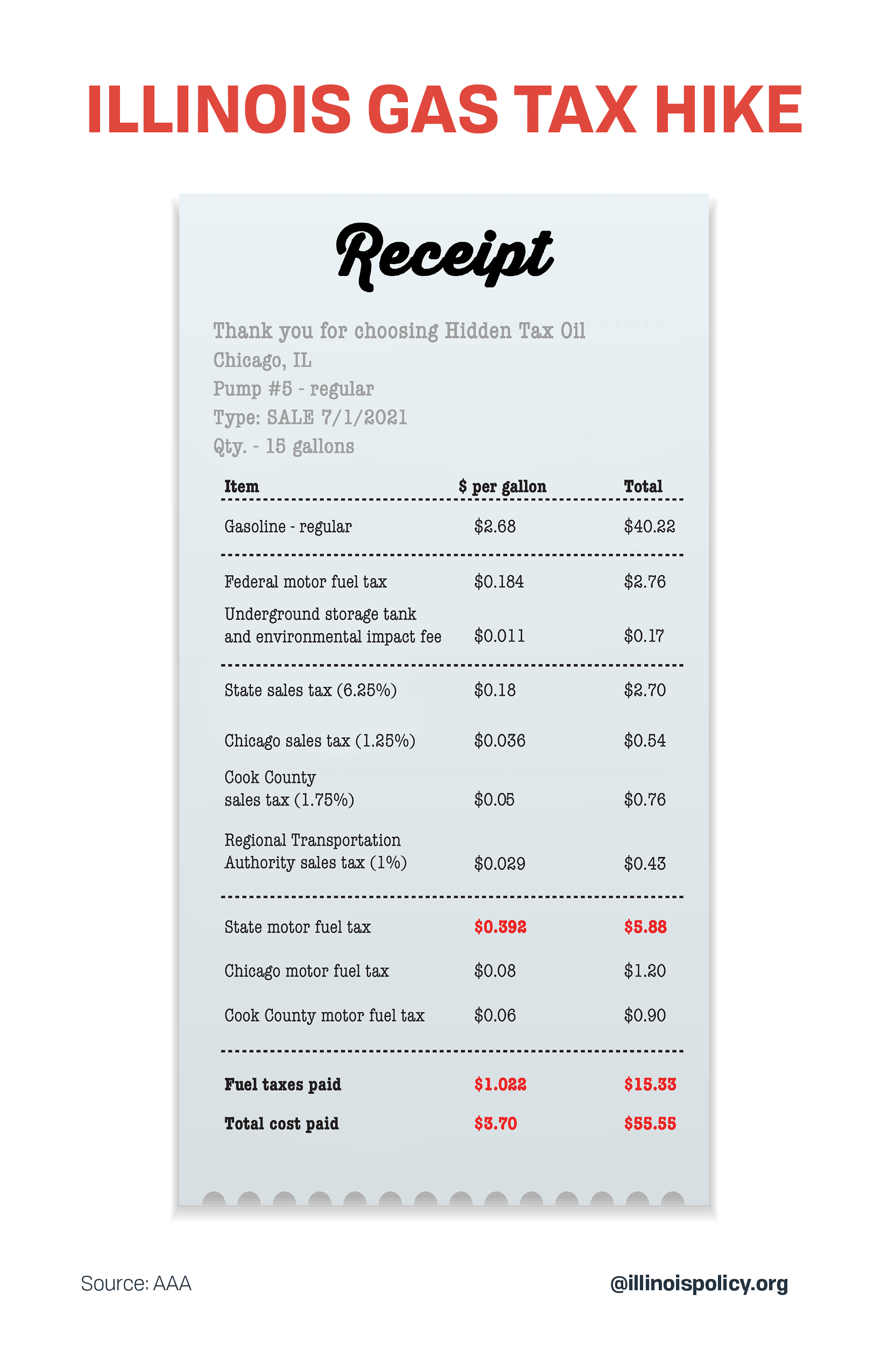

Illinois Doubled Gas Tax Grows A Little More July 1

Parsons Home For Sale Waterfront Homes Home House Styles

Mchenry Township Senior Center Illinois Facebook

The Best School Districts In Illinois In 2014 As Ranked By Schooldigger Http Www Disclosurenewsonline Com 2015 01 25 Th School Fun School District Illinois

Illinois Municipalities Fight To Restore Local Funding

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Tax Extension Mchenry County Il

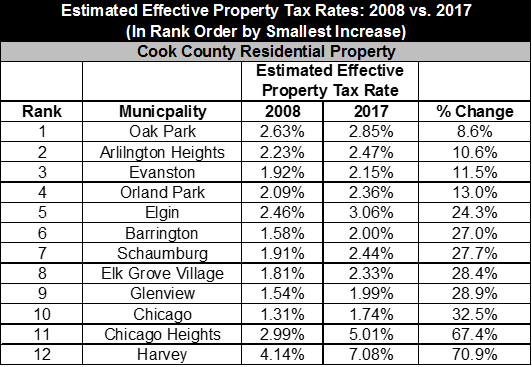

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation